Seniors Struggling Feature No. 2: Homelessness & the Elderly

A stream of media articles these past few weeks – including my own (i.e. the first in this Special Feature Series on Seniors Struggles and the interview I did with Grey Power that led to it ) – have begun highlighting what, in my most recent coverage, I explained was a phenomenon being catalysed by the entry of the Baby Boomer generation’s tail end into its retirement years.

While that long-recognised demographic bulge has caused major impacts as it has moved through each new stage of life, never before has there been the worrying convergence of challenges it is now having to face.

Those challenges all, needless to say, relate to economic trends - some directly, some a bit more indirectly..

The impacts of each of those trends in their own right are challenging enough for anyone . . . but they are far exacerbated in terms of their impact on those leaving their earning years behind them and entering into what, for most people, are the somewhat financially leaner years of retirement.

The cost-of-living crisis (not only food, of course, but skyrocketing electricity prices and unprecedented rates increases) is not looking at easing by any substantial measure any time soon. Reportedly, we’ve seen 12-month rises in insurance costs in the vicinity of an average 19.8%, transport-related costs an average 12.9%, and property rates increases of an average 9.7%. (As an aside on the note of Council rates, TV1 recently interviewed two Wairarapa Martinborough residents who had become "accidental advocates" for widowers, retirees, pensioners finding the local Council’s rate increases untenable.)

An Unprecedented Convergence of Trends

The convergence of this cost-of-living crisis, with an all-time-high housing supply crisis, is exacting a terrible toll on those on incomes which are both low and fixed. Like new retirees and those further up in years . . . a societal cohort that, according to the 2018 census results, is on the increase from what was then 819,600 people aged 65 years and over to an estimated 1.2 million by 2034.

My recent interview with Grey Power’s new National President (“Do we pay the rates, heat a room, or have a proper meal this week?”), outlined the severity and the shameful deprivation in which many Kiwi seniors are now living.

None, though, live in greater indignity and deprivation than those who are no longer able to afford to maintain their own homes (many forced to sell because of now-unachievable Council rates), or worse still, are in the rental market but haven’t been able to find affordable accommodation there.

And that, in its own right, is a cohort with no small expected increase. The Office of the Retirement Commissioner estimates by that 2048 the number of over 65s renting will double, and will sit at a by-then 600,000+ pensioners. At the same time, the Commission’s research (based on interviews with more than 700 landlords) shows the private market will be unable to meet basic supply demands, most especially in the area of accessible rentals.

In short, the bald facts are – says the Retirement Commissioner – that the private rental market will not be able to keep up with the demand for rental housing for the ever-increasing number of pensioners who will need affordable and accessible homes over the coming decades.

Compounding that, according to the Commissioner, one-third of New Zealanders who have a disability are in that 65+ age group: “We want people to remain in their own homes and their established communities, but unless we have an age-friendly private rental sector, that’s not going to be achievable. Traditionally, New Zealanders reaching the age of 65 will have paid out their mortgages and be able to use the equity in it to modify their home for accessibility.

“But that reality is gone."

The Commissioner reported that few landlords had previously had much experience with older tenants, with almost half never having had a tenant over 65 years of age.

That means not only that very few rentals have accessibility modifications, but also that landlords are not accustomed to dealing with costs related to providing them – notwithstanding the fact that many landlords had positive attitudes with regard to older tenants and, in principle, to supporting their needs.

'Just Here for the Heat & the Eats'

One Parliamentarian with a direct and daily view into the issue is Opposition Spokesperson for Seniors, Ingrid Leary.

Leary is also the Member of Parliament for Taieri, one of the most socio-economically disadvantaged and oldest demographic groups in New Zealand.

She says that, in general, low-income areas “are very transient, because there’s a high number of renters and seniors.

“We have people come to events at our Labour Party rooms or to community group events, and they openly admit that they’ve come because they knew we’d have the heaters on and they’d be warm for as long as they were here, and if they’re lucky there will be something to eat as well.

“I know that hardly sounds like New Zealand, does it? But it’s REAL. It’s honestly real. It’s what’s happening out there.

“The people in my electorate are pretty resilient,” says Leary. “It’s never been a wealthy area. But I’ve had seniors ring me traumatised about whether there will be further cuts, and whether they should stay in bed for the day to save getting up and having to heat the house. And because they don’t want to go out the front door because they’ll have to spend money on transport and other living costs.

“And a senior who is forced to hole up in their bed all day for no other reason than to save money, is experiencing poor nutrition, poor health outcomes, social isolation . . . the list goes on.

“So the impacts are far reaching and incredibly negative.”

Beyond Supply Issues & Into the Area of Homelessness

Nowhere to go is one issue. But nowhere to live is an increasing issue, too.

“When I’ve been door-knocking, I’ve had some really heartbreaking conversations with older people who face the very real prospect of having to sell their house or worse still, a mortgagee sale, due to the impact of increases in rates.

“It’s infuriating, because these rates increases could have been minimised had Labour’s Affordable Water proposals not been subject to disingenuous re-framing,” Leary says.

“So they have, or they will, find themselves renters at this late stage of life. And with the level rents are at, even down in my electorate, they’re unable to find accommodation they can afford.”

In her electorate, she’s seen this exacerbated by the “No-Fault Tenancy” legislation brought in by the new Government. She says this incentivises landlords to evict existing tenants if they feel they can’t get a rent rise out of them . . . which, she says, landlords have the confidence to do, given the poor supply of housing.

“To boot, there’s a bias in the rental market against older people. And also, many rentals are larger houses. And how can a senior person fill up the other rooms in a house? A flatmate situation is often not appropriate for a senior.”

Women Particularly Vulnerable

She’s even more viscerally concerned about the number of calls for help that her electorate office is fielding from women on their own, over 65.

“It would seem that this is particularly an issue for women; for some reason. There’s a particularly strong bias against women in the older age group.

“Many older women don’t have a nest egg to rely on at all. It’s well-evidenced that many come into retirement with a smaller Kiwi Saver, both because of pay inequities and because of time taken out of their work life to raise children.

“And some are single, or single again."

So what are they doing?

Horrifyingly, some are “couch-surfing”.

“They’re living with a friend for a few weeks, trying not to overstay their welcome, before moving on to another friend, and spending a lot of that ‘grace time’ trying to find more permanent options or yet another benevolent friend who will accommodate them.

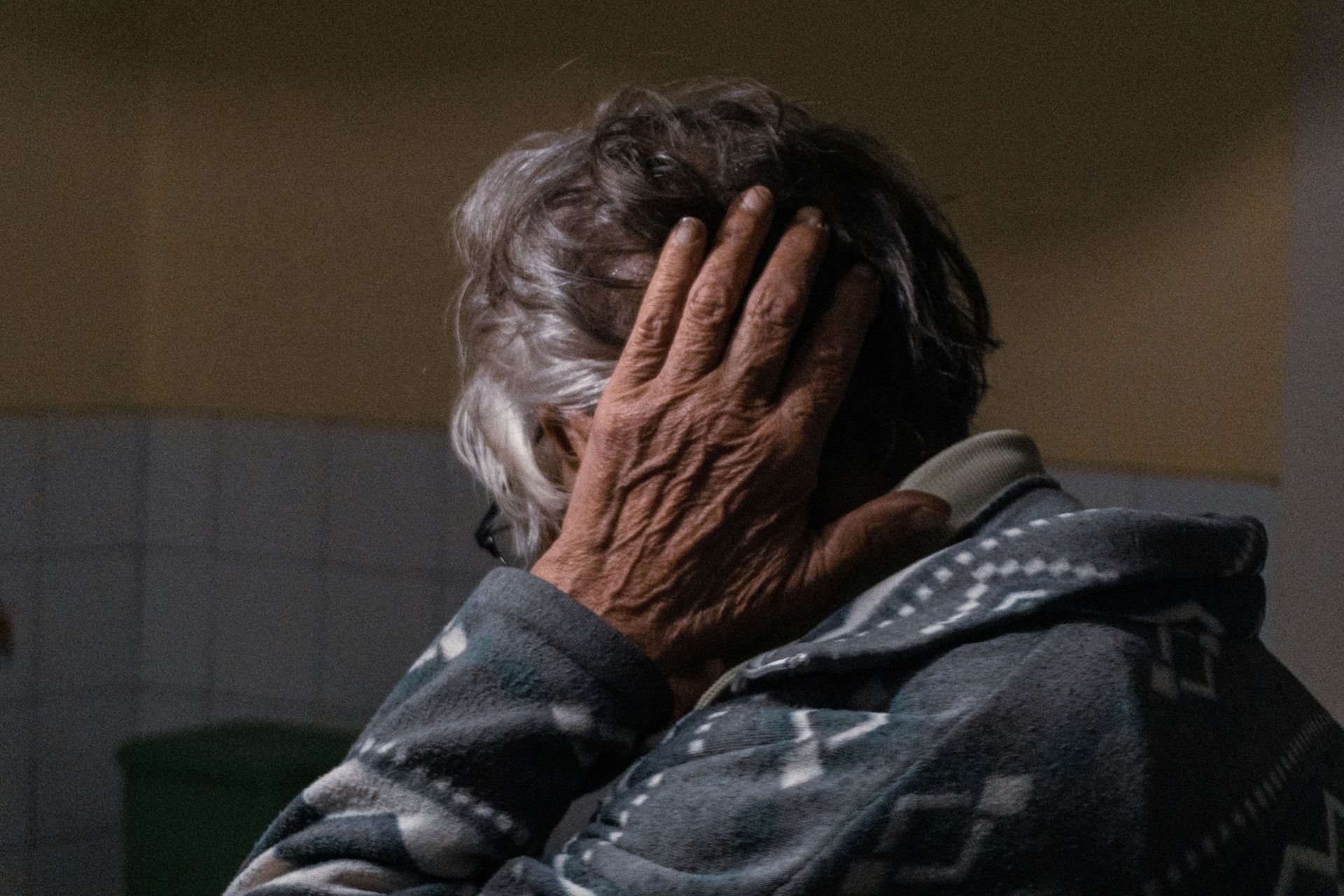

“This all comes with a LOT of stigma for these women. They don’t want people to know that they are couch-surfing or that they are in insecure accommodation, so they find it difficult to ask for help. (They also often don’t know what their benefit-related entitlements are, which exacerbates their already traumatising situation.)

“And with that unfair burden of shame, can easily come resultant mental health issues such as depression and anxiety.

“It’s incredibly stressful to not know from day to day, how long they can stay under the current roof that is kindly but temporarily accommodating them."

Leary says many seniors end up living with relatives (if they have them).

"That isn’t always a great thing, and it’s particularly not good when it’s forced through adversity rather than being a matter of choice. It puts a strain on familial relationships. As well, there might simply not be enough room in the house for all its occupants.”

That whole situation, she points out, has further potential ramifications, in that it can set the scene for elder abuse.

“It’s BAD,” stresses Leary. “We’ve never really thought of this being a reality in New Zealand. But it has become one, and it’s going to get worse unless solutions are identified and found. And FAST.”

Other News, Reviews & Commentary